Communication Fraud 101

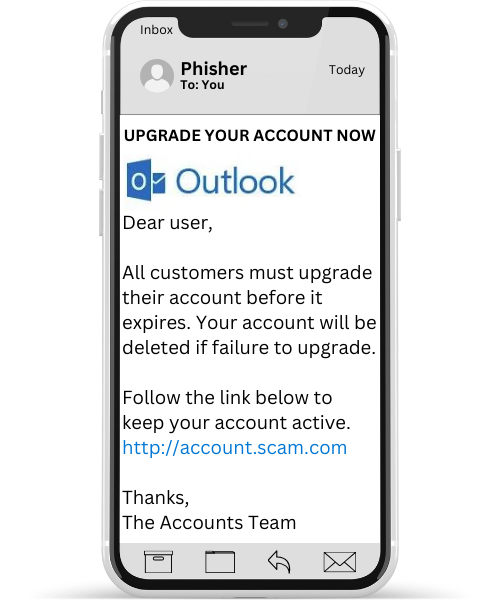

DEFINITIONS

Review the Rundown

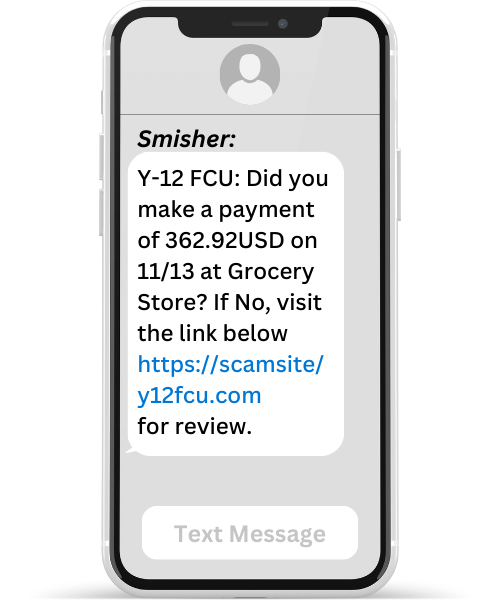

SMISHING SCAMS

Conquer Smishing Shenanigans

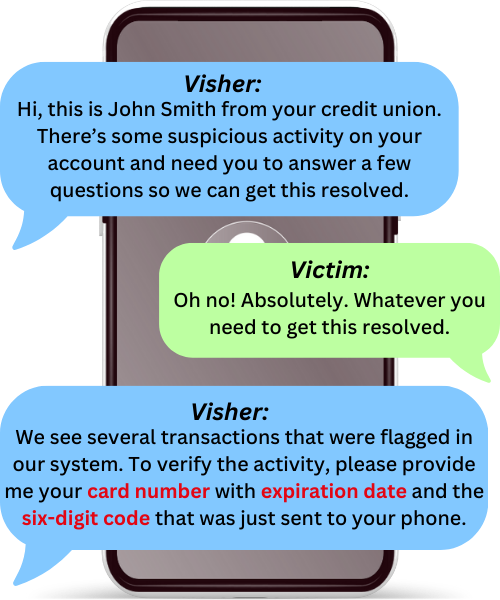

Bank on the fact that we will NEVER:

Ask for card info

PRO TIP:

When in doubt, reach out.

Request your login info

PRO TIP:

If account info's their wish,

it's probably a phish.

Use an unrecognizable number

PRO TIP:

Pause and think if you

receive a weird link.

CONTEST SCAMS

Unmask prize ploys

Here's how it usually goes down:

MARKETPLACE SCAMS

Master the art of buyer beware

Spot red flags like a pro.

Too Good To Be True

Requests for Personal Info

Urgency Tactics