![]() "This is an exciting and transformative moment for our organization. The completion of this acquisition allows us to bring our Credit Union membership benefits to thousands of new individuals and businesses throughout Southeast Kentucky and Northeast Tennessee. We’re honored to continue FSB’s long-standing community legacy while introducing expanded services and digital tools that create even more financial opportunity."

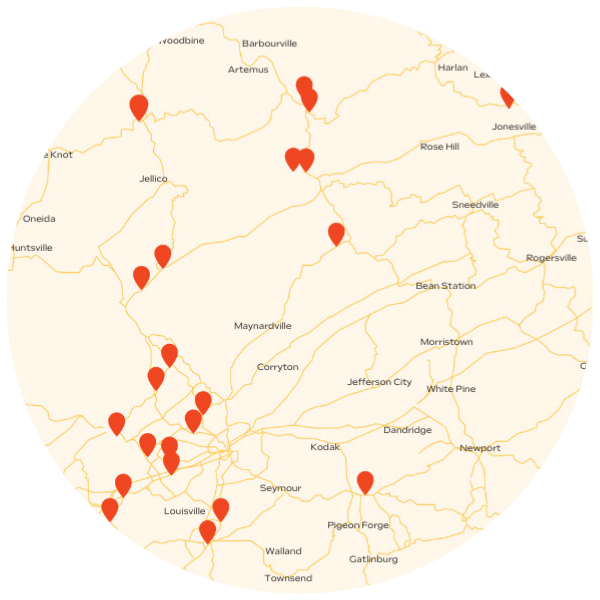

"This is an exciting and transformative moment for our organization. The completion of this acquisition allows us to bring our Credit Union membership benefits to thousands of new individuals and businesses throughout Southeast Kentucky and Northeast Tennessee. We’re honored to continue FSB’s long-standing community legacy while introducing expanded services and digital tools that create even more financial opportunity."

- Dustin Millaway, Y-12 Credit Union President/CEO